“An effective guide to using personal finance management apps”

Why use a personal finance management application?

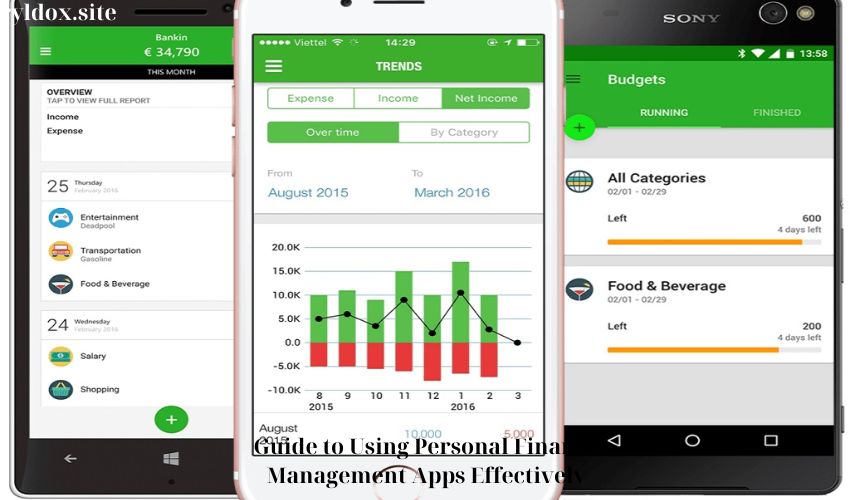

Using a personal finance app has many benefits. First, it helps you track and control your cash flow easily and effectively. You can view an overview of your income and expenses and track your spending by category, from savings to fixed expenses. This gives you an overview of your personal finances and makes it easier for you to make smart decisions about spending and investing.

In addition, the financial management application also helps you build a suitable personal financial management plan. You can set up a monthly budget and track specific spending plans, helping you save and invest effectively. In addition, using the application also helps you track and manage your loans, ensuring that you do not get into too much debt and can pay off your loans effectively.

Finally, using a personal finance management app saves you time and effort. Instead of having to manually record and calculate, you can easily enter information into the app and it will automatically categorize and display the data clearly. This helps you focus on managing your finances more intelligently.

With the above benefits, using personal financial management applications becomes extremely necessary and useful in effectively managing personal finances.

How to choose the right financial management application

Choosing the right financial management app is crucial to help you manage your personal finances effectively. Here are some steps you should consider when choosing a financial management app:

1. Determine the purpose of use

Before choosing an app, be clear about your goals. Do you want to track your daily expenses, manage your budget, invest, or save? This will help you choose the right app for your needs.

2. Essential Features

The financial management features needed may vary from person to person. You should consider features like expense tracking, budget planning, creating spending categories, financial reports, calculating investment returns, and more to ensure that the app meets your needs.

3. Flexibility and ease of use

A financial management app should be flexible and easy to use so you can easily enter data, view information, and perform operations conveniently. Look for apps that have a friendly interface and high flexibility.

With the above steps, you can choose a financial management application that suits your needs and desires.

Basic operations on personal finance management application

When using a personal finance app, there are some basic operations that you need to know to get the most out of the app’s features. Here are some basic operations you can perform on the app:

Add transaction

– Step 1: Open the app and select the “Add Transaction” option or similar icon.

– Step 2: Enter transaction information such as transaction type, date, amount, and description if needed.

– Step 3: Save the transaction information.

View charts and reports

– Step 1: Select the “Chart” or “Report” option on the app.

– Step 2: Select the specific time period or type of report you want to view.

– Step 3: View and analyze charts and reports to better understand your personal financial situation.

Set a budget

– Step 1: Select the “Budget” option or similar icon.

– Step 2: Identify the expenses that need to be budgeted and assign a budget level to each.

– Step 3: Monitor and update the budget over time.

Here are some basic operations that you can perform on your personal finance management application. Understanding and using the application effectively will help you manage your personal finances intelligently and effectively.

How to enter and categorize expenses in the app

How to enter data

To effectively manage your personal finances, it is important to enter your expenses into a financial management application. You can do this by recording all your daily expenses, from shopping, incidental expenses to food expenses. You can also do this by taking pictures of your receipts and storing them in the application for easy tracking later.

How to classify expenses

After entering data, you need to categorize your expenses to get an overview of your financial situation. Common categories include: daily expenses, electricity, water, food, shopping, entertainment, savings, and investment. Categorizing expenses helps you better understand the level of spending in each area and thereby have a more reasonable financial management plan.

Use financial management app on phone

In addition to manual data entry and categorization, you can also use financial management applications on your phone to automatically enter and categorize your expenses. These apps will help you automatically record your expenses by connecting to your bank accounts and credit cards, thereby creating detailed and easy-to-track spending reports.

Take advantage of reporting and statistics features on the app

Using the reporting and statistics feature on the personal finance management application will help you have an overview of your income and expenditure situation. You can view charts and graphs of expenses, income, and savings over a specific period of time. This helps you easily evaluate and monitor your financial situation scientifically and effectively.

Reporting and statistics features that may be useful include:

- Income and Expense Chart: Shows an overview of income and expenses over a given period of time.

- Savings graph: Shows you how well you’re saving against your set goal.

- Spending Analysis: Provides detailed information on spending by category, helping you identify and adjust spending effectively.

Using this feature will help you manage your personal finances more scientifically and intelligently, thereby achieving your financial goals effectively.

How to set budgets and financial goals on the app

When setting up your budget and financial goals on the app, there are some important principles you need to follow to ensure effectiveness. Here are some specific steps you can follow:

1. Identify specific financial goals

– List all the financial management goals you want to achieve and arrange them in order of priority.

– Set clear priorities for your goals so that your financial plan is as detailed as possible.

2. Use a financial management app on your phone

– Use the financial management app on your phone to get an overview of your income and expenses.

– Record your expenses and track your monthly budget through the app.

3. Set up a clear spending plan

– Create a monthly spending plan and milestones for easy tracking.

– Add multiple steps or milestones for easy tracking.

By following the above steps and using a financial management app on your phone, you can easily set your budget and financial goals effectively.

Benefits of Using Personal Finance Management Apps

1. Convenient and easy to track spending

Using a personal finance management app makes it easy to record and track your daily expenses. You can enter data as you spend and get an overview of your finances anytime, anywhere.

2. Categorize expenses and create an effective budget

Personal finance management apps allow you to categorize your spending into categories such as food, travel, entertainment, savings, and investments. This helps you better understand how you spend your money and create an effective budget for each spending category.

3. Calculate and predict future finances

Personal finance management application has the feature of calculating and predicting future finances based on current spending data. This helps you have a clear view of your future financial situation and adjust your spending and investment plans accordingly.

How to handle and solve problems when using financial management applications

When using a financial management application, you may encounter some problems such as data synchronization, technical errors, or difficulties in using the interface. To solve these problems, you can apply the following methods:

Check internet connection

First, if you are having problems with data synchronization, check your internet connection. Sometimes the problem can come from an unstable internet connection, causing data synchronization to be interrupted. Make sure you are using a strong and stable internet connection to resolve this issue.

Update the application

If you encounter technical errors when using your financial management app, check to see if you have updated to the latest version of the app. The developer may have released bug fixes or new feature updates that resolve your issue.

Contact support

If you still have difficulty using the financial management application, do not hesitate to contact the developer’s support. They will be able to provide technical support and help you solve the problem quickly and effectively.

At the same time, you can also refer to online forums or community groups of app users to seek help from people who have experience using financial management apps.

Notes when using personal financial management applications

Choose a reputable and trustworthy application

Before using any financial management app, make sure that it is developed by a reputable and trustworthy company. Read reviews from previous users and learn about the app’s features and security.

Synchronize data regularly

Make sure you sync your data regularly to avoid losing important data. If possible, use apps that have automatic backup features to keep your financial data safe.

Pay attention to personal information security

Before providing any personal information on a money management app, make sure the app has strong security measures in place to protect your information. Always keep the app updated to get the latest security patches.

Methods for testing and evaluating the effectiveness of using personal financial management applications

To test and evaluate the effectiveness of using personal financial management applications, you can apply the following methods:

1. Determine goals and evaluation criteria

First, you need to clearly define your purpose for using a personal finance management application. Do you want to track daily expenses, manage your budget, invest or save? Then, determine the criteria for evaluating the effectiveness such as the application’s features, interface, flexibility and security.

2. Using the application for a long time

To evaluate its effectiveness, you need to use the personal finance management application for a long time to have a comprehensive view of the application’s features and performance.

3. Comparison with other applications

In addition to using a single app, you should also compare it with other personal finance management apps to evaluate the features, performance, and utility of the app you are using.

4. Collect feedback from other users

Collecting feedback from other users will help you better understand the pros and cons of the personal finance management application you are using. You can join forums and online discussion groups to find out the opinions of other users.

The above methods will help you evaluate the effectiveness of using personal financial management applications comprehensively and accurately.

In conclusion, using an effective personal finance management application helps users save time, grasp their financial situation and create a clear budget plan. This helps them manage their spending and savings better in their daily lives.